Economic and Political Developments Impacting the Market

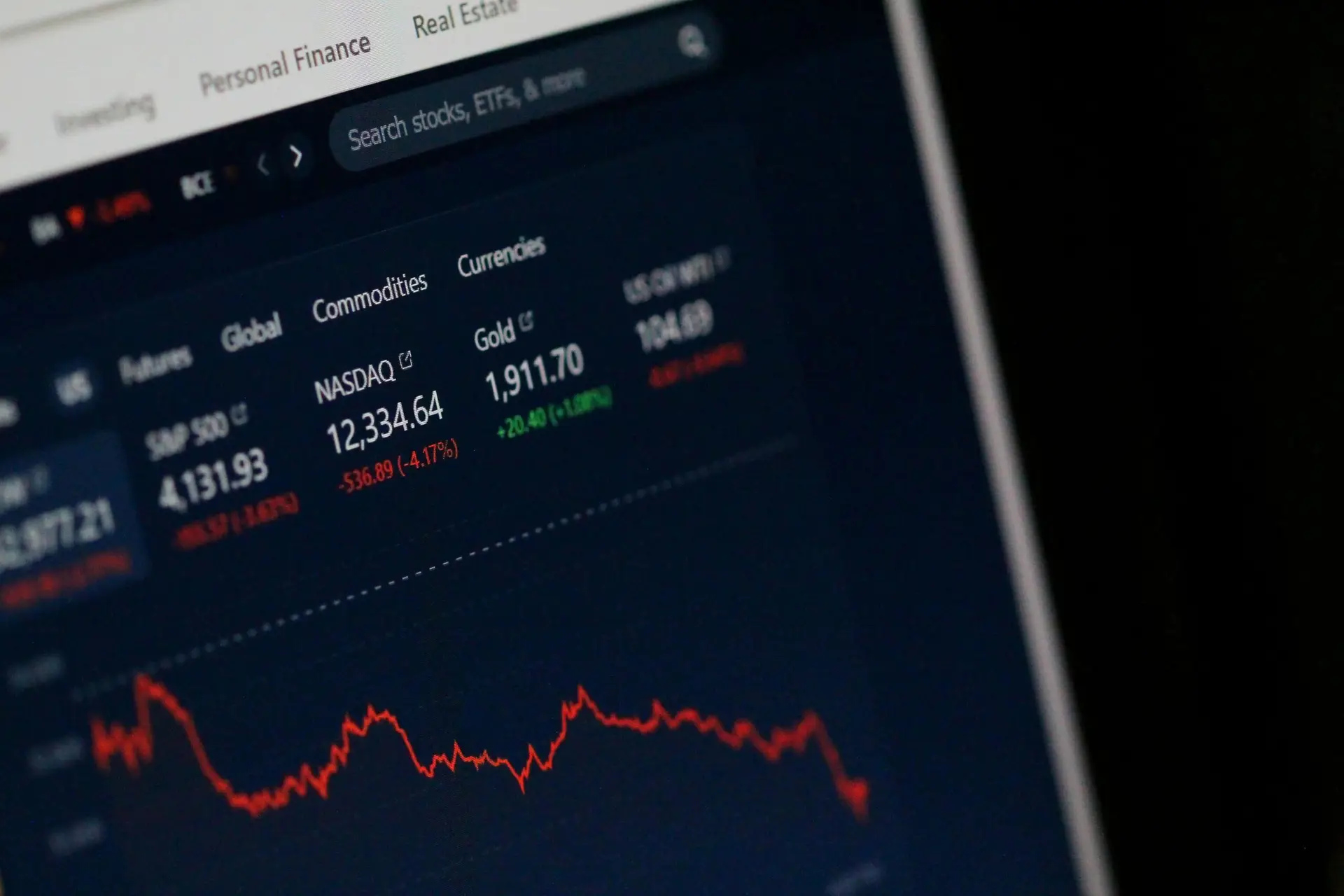

As of July 2024, the global economic landscape remains dynamic, characterized by a series of developments that have had profound impacts on market conditions. Among the key economic indicators, GDP growth has shown a mixed picture across different regions. Developed economies, particularly in North America and Europe, have experienced moderate growth, driven by robust consumer spending and technological advancements. However, emerging markets face challenges, with some regions grappling with slower growth due to political instability and supply chain disruptions.

Inflation rates have been a focal point for economic discussion, with many countries experiencing inflationary pressures. Central banks have responded with varying strategies, from interest rate hikes to quantitative tightening, aiming to maintain price stability without stifling growth. The employment landscape is also noteworthy, with unemployment rates declining in several major economies. This trend reflects a recovery from pandemic-induced job losses and a shift towards more resilient and flexible labor markets.

On the political front, several significant events have shaped market sentiments. Recent elections in key nations have resulted in shifts in political power, influencing policy directions. For instance, policy changes in the United States, including new regulatory frameworks in the technology and energy sectors, have had ripple effects on global markets. Additionally, legislative actions aimed at addressing climate change and promoting sustainability have introduced new compliance requirements and investment opportunities.

Trade policies continue to be a critical factor, with ongoing negotiations and trade agreements affecting international commerce. The geopolitical landscape remains tense, with conflicts and diplomatic tensions contributing to market volatility. Investor confidence is closely tied to these political developments, as stability and predictability are crucial for long-term investment strategies.

Overall, the interplay between economic indicators and political actions is shaping the market environment in 2024. Stakeholders must navigate these complexities, balancing risks and opportunities to achieve optimal outcomes in an ever-evolving global economy.

The Immediate Impact of Climate Change: A Focus on Recent Temperature Extremes

The year 2024 has been marked by unprecedented temperature extremes, significantly impacting various sectors of the market. Recent data indicates that global temperatures have continued to rise, leading to more frequent and severe heatwaves. These climatic changes have had immediate and far-reaching consequences on industries such as agriculture, real estate, and energy.

In the agricultural sector, extreme temperatures have led to reduced crop yields and poor harvests. Heat stress has adversely affected staple crops like wheat, corn, and soybeans, causing a decline in productivity. Farmers are grappling with increased irrigation needs and higher costs of maintaining crop health, which in turn have driven up food prices. This inflationary pressure has cascaded down to consumers, altering spending habits and impacting overall market demand.

The real estate industry has not been immune to these climatic shifts. Properties in regions prone to extreme heat have seen fluctuations in value. Homeowners and investors are increasingly considering climate resilience as a critical factor in property valuation. The cost of maintaining cooling systems and other climate adaptation measures has surged, leading to higher operational costs for both residential and commercial properties. Additionally, regions experiencing severe heatwaves have seen a decrease in tourism, affecting local economies and real estate markets.

Energy consumption patterns have also shifted due to rising temperatures. The demand for electricity has spiked as households and businesses rely more heavily on air conditioning. This increased demand has strained power grids, leading to higher energy prices and occasional blackouts. Energy companies face the dual challenge of meeting higher demand while managing the operational costs associated with maintaining infrastructure under extreme conditions. As a result, energy prices have become more volatile, impacting both consumers and industries reliant on stable energy supplies.

Moreover, supply chains have experienced significant disruptions due to climate-related events. Transportation networks have been compromised by heat-damaged infrastructure, causing delays and increased shipping costs. Industries reliant on timely deliveries, such as manufacturing and retail, have faced challenges in maintaining inventory levels, leading to production halts and lost revenue. These disruptions underscore the interconnectedness of climate events and market stability.

Ultimately, the immediate impact of climate change, evidenced by recent temperature extremes, has created a ripple effect across various sectors. The resultant operational challenges, cost increases, and shifts in consumer behavior underscore the need for adaptive strategies to mitigate climate-related risks and sustain market performance.

Future Projections: Positive Market Changes Driven by Climate Adaptation and Innovation

As we move through 2024, a significant transformation is emerging within the market, driven by climate adaptation and innovation. Recent advancements in sustainable technologies are playing a pivotal role in reshaping industries and creating new economic opportunities. For instance, the renewable energy sector has seen unprecedented growth, with solar and wind energy projects becoming more economically viable and increasingly adopted by both public and private sectors. These advancements are not only reducing reliance on fossil fuels but are also generating new jobs and stimulating economic growth.

Government initiatives for green infrastructure are also making a substantial impact. Policies and incentives that promote sustainable construction, energy-efficient buildings, and electric vehicle adoption are fostering an environment where businesses can thrive while contributing to environmental sustainability. The introduction of green bonds and sustainability-linked loans are providing the necessary capital for companies to invest in eco-friendly projects, thereby driving market expansion.

Corporate commitments to reducing carbon footprints are further reinforcing this trend. Leading companies across various sectors are setting ambitious targets for carbon neutrality and implementing comprehensive sustainability strategies. These initiatives are not only enhancing their corporate image but are also proving to be financially beneficial. For example, companies that have invested in energy-efficient technologies and waste reduction processes are experiencing significant cost savings and operational efficiencies.

Case studies of industry leaders demonstrate the potential for broader market improvements. Tesla’s advancements in electric vehicles and battery storage technologies serve as a prime example of how innovation can drive market growth. Similarly, Unilever’s sustainability programs, which focus on reducing plastic waste and promoting sustainable sourcing, highlight the positive impact of corporate responsibility on market dynamics. These successes signal a promising future where climate resilience and innovation are integral to market performance.

Overall, the integration of climate adaptation strategies and innovative solutions is poised to create lasting positive changes in the market. As companies and governments continue to prioritize sustainability, the market is expected to see enhanced resilience and growth, paving the way for a more sustainable and prosperous future.

Market Trends in South Florida: Challenges and Opportunities for Growth

The South Florida market is currently navigating a complex landscape, characterized by both significant challenges and promising opportunities for growth. One of the most notable aspects is the recent surge in real estate developments. With a steady influx of new residents and investors, the region has seen a marked increase in both residential and commercial construction. This boom is driven by a combination of attractive housing prices, favorable interest rates, and the appeal of South Florida’s desirable climate and lifestyle.

However, this growth is not without its challenges. The real estate market is grappling with issues such as rising construction costs and a shortage of skilled labor. Additionally, the increasing demand for housing has led to concerns about affordability and the potential for market saturation. Despite these hurdles, innovative solutions such as modular construction and public-private partnerships are emerging to address these issues and sustain growth.

Tourism remains a cornerstone of South Florida’s economy. Recent trends indicate a robust recovery in visitor numbers, buoyed by the easing of travel restrictions and the region’s enduring appeal as a vacation destination. The local hospitality industry has adapted by enhancing health and safety protocols and investing in digital transformation to improve visitor experiences. This sector’s resilience is bolstered by significant investments in infrastructure and marketing initiatives aimed at diversifying the tourist base.

Local economic policies are also playing a crucial role in shaping the market. Initiatives aimed at fostering business growth, such as tax incentives and grants, are attracting new enterprises and encouraging expansions. These policies are designed to create a more conducive environment for innovation and entrepreneurship, which are vital for long-term economic stability.

Adapting to climate change is another critical aspect of South Florida’s market dynamics. The region is on the forefront of implementing innovative infrastructure and urban planning solutions to mitigate environmental impacts. Efforts include the development of resilient coastal defenses, investment in green building technologies, and comprehensive urban planning that integrates sustainability at its core. These initiatives not only protect the local environment but also enhance the region’s appeal to environmentally-conscious investors and residents.

Overall, South Florida’s market is a tapestry of challenges and opportunities. The region’s ability to navigate these complexities through strategic innovation and adaptive policies will determine its trajectory in the months ahead. The focus on sustainable growth, coupled with a proactive approach to economic and environmental challenges, positions South Florida as a resilient and dynamic market poised for recovery and expansion.